Logic dictates that I have to continue to favor the bears at this juncture, due to all the circumstantial evidence. But indicators and historical studies don't always play out as expected. The bulls have an intact uptrend; while it seems the bears have just about everything else.

For the bulls to show that they're serious, the market needs to break above, and hold, 1310. A head-fake breakout briefly above 1310 wouldn't do much technical damage to the bear case; but sustained trade above that level might. You'll see what I mean when we look at the longer-term charts. In any case, we have to be prepared for the possibility.

Fundamentals seem to favor the bears as well, especially if you believe that governments need to take in more money than they're spending in order to be considered solvent. But as Keynes said, "The market can remain irrational a lot longer than you can remain solvent."

Given the current fundamentals, my twist on that old saying would be: "The market can remain insolvent a lot longer than you can remain rational."

Certainly, despite particular fundamentals, there may be bullish influences acting behind the scenes that we simply can't see. The cash fleeing Europe into the U.S., which we discussed yesterday, is clearly one contributing factor. The European Central Bank's operations are certainly another -- and Lord only knows what Uncle Ben's up to half the time.

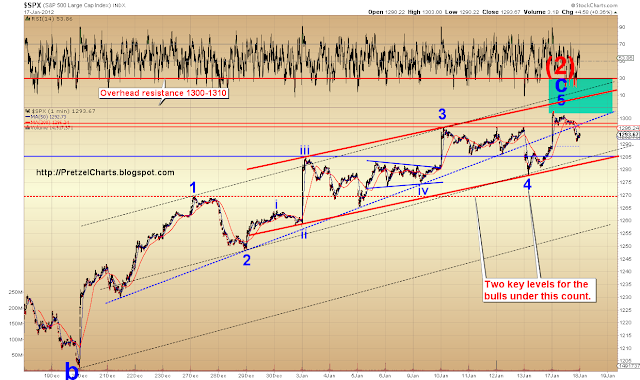

The charts are now pointing to a big move -- which direction it heads is going to depend on whether 1310 is captured by the bulls or not. There's one potential count which could put finally the bulls to rest -- but it's one of those patterns that, if it doesn't play out for the bears, could morph into another melt-up rally.

Before we get to the short term charts, let's take a look at some longer-term indicators and patterns, and some of the reasons I remain inclined to favor the bears over the intermediate term. The first chart shows a very interesting divergence between the broad-based NYSE Composite index and the SPX. In 2009, the NYA supported the SPX's rally -- in fact, it often led. This showed that investors weren't just buying a few select stocks, but were buying the broader market -- "A rising tide lifts all boats," as they say. Currently the NYA is lagging the SPX considerably, and has yet to break above its October highs. The last time the two indices diverged like this was August 2008.

The next chart is a daily SPX chart and shows some secondary indicators. These indicators behave in certain ways during bear markets, and in different ways during bull markets. There are two things of note on the chart:

1) The relative strength index (RSI) is still in "bear-market bounce" territory.

2) Standard deviation was still showing bear market volatility levels as recently as last month.

The next two charts are the short term wave counts. Whoever wins the battle around 1310 will probably determine which of these is unfolding. The preferred count (below) suggests the top could form today or Monday.

The alternate count suggests the market could run into the 1325-1350 zone. The concern I have with this alternate count is that the move it suggests could potentially flip many long-term indicators into a bullish position. If this second count unfolds, we'll have to watch the indicators carefully - but we'll worry about that if and when we come to it.

In conclusion, the 1310 zone remains important. Again, based on the preponderance of evidence, logic dictates that I favor the bears over the intermediate term -- but logic doesn't always work when it comes to the market. Trade safe.

The original article, and many more, can be found at http://PretzelCharts.blogspot.com