Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Friday, March 20, 2020

SPX, INDU, OIL: Oil Finally Captures Nine-Year-Old Standing Target

Last update discussed that new lows looked likely, but warned of the possibility of a complex correction, as follows:

In the forums, I noted that the low appeared that it might be a b-wave, and b-wave lows imply further lows to follow. If we make a new low tomorrow, that b-wave call will be confirmed.

That said, we should at least be alert to the potential of (as I also wrote in the forum) an increasingly complex correction -- which could take the form of a "slight" (which could be 70+ SPX points, in this crazy market) new low, then a run back up toward yesterday's high, followed by yet another new low. That's definitely an option here, given the past couple days of chop.

The b-wave low was indeed confirmed, and -- in futures, anyway, the complex correction may have played out (or may still be playing out). The question now is where the market wants this apparent ongoing b-wave low to begin: It could begin near ~2553 -- or it could begin near ~2710. Rallies slightly beyond either of those zones MIGHT thus suggest new lows STILL NEEDED. We'll see how it develops from here. Because...

Yesterday, the market tested a significant triple resistance zone -- and so far, it has failed to get back above:

Bigger picture, there is obvious support causing this chop zone. INDU reached the red "stealth" trend line I had noted previously:

While at the same time reaching a horizontal support level I'd previously noted. Together with the above, that qualifies as a confluence of support:

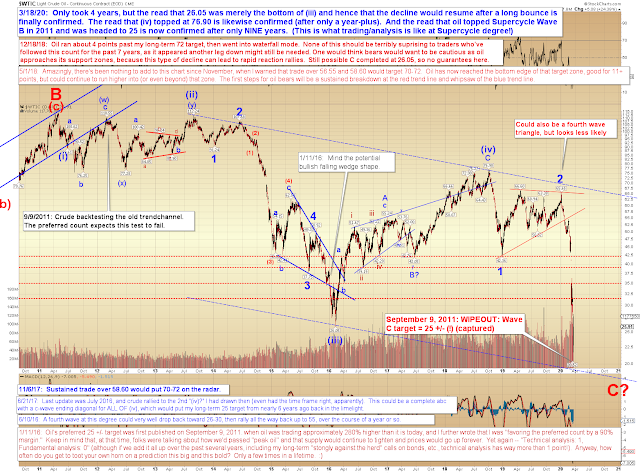

Finally... oil now qualifies as one of my longest running strings of hits (in terms of time, with my original call dating back to 2011), and gives equities traders a glimpse at what it's like trading a decline at Supercycle degree. In 2016, oil tagged 26, which was AWFULLY close to my standing 25 target, and the pressure was on to call that a wrap -- but instead, I predicted a fourth wave bounce that would last a year or longer (it lasted almost 2 years), which would then be followed by a fifth wave decline to finally, once and for all, truly capture the standing 25 target.

This week, that target was officially captured.

After a nine-year wait (!).

In conclusion, the first zone for equities bulls to beat appears reasonably clear; if they want to get even a short-term rally going, they will need to sustain trade back into the blue base channel. Even if we rally all the way back up north of 2745 from here, at present, it is difficult to reconcile the low as a clean pattern, which thus still implies a b-wave, and thus still implies that new lows remain on the horizon -- either directly (if resistance continues to hold), or after a larger bounce. Trade safe.

Tuesday, March 17, 2020

INDU and SPX: Historic Call in a Historic Market

Last update noted that the preferred count target had been captured, and mused whether bulls could find support in that zone. They did find enough support to put together a decent bounce, but that bounce has all but been retraced in futures, which are limit down yet again this evening. In the forums, I noted that the low appeared that it might be a b-wave, and b-wave lows imply further lows to follow. If we make a new low tomorrow, that b-wave call will be confirmed.

That said, we should at least be alert to the potential of (as I also wrote in the forum) an increasingly complex correction -- which could take the form of a "slight" (which could be 70+ SPX points, in this crazy market) new low, then a run back up toward yesterday's high, followed by yet another new low. That's definitely an option here, given the past couple days of chop.

The worst case scenario (for bulls, and probably for everyone at this point) is still the dreaded fifth wave extension. As of yet, there's simply no way to predict if that will occur... but the setup definitely makes it possible. In fact, I ALMOST want to make that the preferred count, but I just can't wrap my head around it.

Since we are now, amazingly, PAST my original crash count target (which looked crazy enough when I first published it), I have highlighted some additional potential horizontal support zones, in blue. Any of those could pause or end the decline. The red megaphone is also a zone to watch, if we get there:

Next up, we can see INDU has reached the bottom of the long-term channel that stretches back to the March 2009 lows, which led to the bounce of the past couple sessions:

If SPX wants to match INDU, it could definitely run a bit lower:

Finally, I do also want to publish here (publicly) my February 27 forum-only VIX prediction, just for the record.

On Feb 27, I warned we could "easily see VIX in the 80s" before this wave was complete. (As if there should be anything "easy" about VIX making history!)

On Monday (and again yesterday), VIX got there, as it traded above 80 for only the second time in history. Long-time followers know I have never previously published anything like this in the forum -- so it's not like I've called for historic 80+ VIX levels a bunch of times and finally got it right.

I called it once -- and it hit.

And considering that we were BULLISH right up until a few points away from the all-time high, when we switched to a bearish footing, these (including the broad market crash call, and the oil down to $25+/- call) are (theoretically, I suppose) once-in a lifetime calls.

I also want to emphasize that since VIX has been in the 80s only once in prior history (October-November 2008), the odds of hitting a one-try call like this purely "randomly" are infinitesimal -- borderline impossible. I've said it before and I'll say it again: Anyone who believes the market is completely random and unpredictable simply doesn't understand the market. It is indeed SOMETIMES unpredictable (such as now; whether the fifth wave will extend or not), but there are many times when it is wholly predictable, at least in a "odds strongly favor XYZ resolution" manner.

Anyway, very, very few analysts are able to include these kinds of hit predictions in their resumes, so forgive me for wanting to document this publicly! :)

Thus, here's a screenshot of what I wrote in the forum on February 27, when VIX was still trading in the 30s:

In conclusion, we are still in an inflection zone for INDU, but if the futures action is any guide, we may make new lows tomorrow. If we do, at least remain alert to the potential for a complex correction (discussed earlier). Such corrections are not "predictable" per se, but it would not be unusual to see such a correction develop in this position. Trade safe.

Monday, March 16, 2020

SPX and INDU: Preferred Target Captured in Full -- Can Bulls Find Support Here?

So the Fed finally announced QE 28 (or whatever number we're on now) and zero interest rates and free balloons for the kids, and everyone is freaking out because the market isn't responding on a dime... but people do need to keep in mind that the money doesn't typically hit the market instantly. Here's a chart showing the first three QE announcements vs the S&P 500:

(chart source)

We can see that in the case of QE1, the market was still several months away from a bottom. QE2 came during an uptrend, as did QE3 -- but there was still a sell-off after the QE3 announcement, even in the context of an ongoing rally.

Thus, it's a bit premature to proclaim: "OMG, it's NOT WORKING!"

I think what's scaring people this time is the sheer speed of the decline. At the present trajectory, if the current QE program doesn't have an impact for several months, then the S&P will be trading below zero before it does. Obviously, that's tongue-in-cheek and not going to happen. But we can certainly trend lower -- potentially MUCH lower, as we'll see -- but bears do need to remember that in itself doesn't mean QE 28 isn't working and will never work, or that the Fed won't get even more aggressive.

If the large B-wave high is correct -- and, given that the market has followed the projection of February 26 to a T so far, we have no reason to believe it isn't -- then at some point QE WILL work, and the market will rally toward new all-time highs. And it will likely trap a whole lot of bears when it does -- but one day at a time, and with declines that lose 10% per day, the market could well make much lower lows in the interim.

Because, ultimately, the Fed is trying to prevent a massive margin call/credit event. These are indeed dangerous times, and the market knows it.

Nevertheless, it might do bears good to remember that the Fed's purchases don't begin until Monday (today), with a first installment of $40 billion.

So: Could the market bottom fairly directly? Indeed it could. As I noted last update, we were in the ballpark where we could count five complete waves down from the all-time-high, but I felt that the pattern would probably look a little cleaner with a new low (still not required, but preferred). Perhaps today/tomorrow we get that new low, and that completes the pattern.

What bulls need to fear here is the dreaded fifth wave extension. And the market is indeed in a position where a fifth wave extension could materialize, so I urge bulls to remain VERY cautious. Because the worst case scenario is mind-bogglingly bad.

The worst case extended fifth scenario is...

Are you sitting down?

12,177 +/- on the Dow Jones Industrial Average

Am I predicting that? No. Not yet, because the market could put in a standard fifth here, and bottom relatively soon. But I want it out there, because bulls have been trying to knife-catch for a while, and I have to believe it's killing them. We have yet to see an impulsive rally. And as my standing advice has always been at such times: It is wise to await one.

That said, if one has shown discipline the whole way down and patiently awaited the target zone, then this is one area one MIGHT dip a toe -- we'll look at why in the upcoming charts. (btw, NOT trading advice; this is an unprecedented market.)

Either way, let's look at where we are, starting with the INDU micro count that Stockcharts failed to save on Thursday evening. I swear on all that is holy that Wave IV ran to RIGHT WHERE I HAD IT DRAWN. Long-time readers know me well enough to know this is actually pretty common for my work. INDU's new low today will potentially complete the pattern for a STANDARD (non-extended) fifth.

Next, the longer-term chart, where we can see two channel support zones. Horizontal support (which theoretically should exist) is not shown on this chart:

Next, note the preferred count target on INDU will be captured as of the open (added just now, after the open, to show this) -- a pretty historic call, if I do say so myself:

Next up, a chart being shown simply to note that the prediction was captured (likely won't show this chart again), simply to "close it out":

Finally, SPX, which does NOT need to break its comparable low:

In conclusion, last update noted that the charts would look better with a new low, and we will get that new low today. INDU has captured its preferred target, which gives me bragging rights for the next decade (possibly beyond, lol). If the market does a STANDARD fifth wave, then it could very well bottom soon. If it does an extended fifth... well. All I can say is let's hope it doesn't. Trade safe.

Sunday, March 15, 2020

Sunday Thoughts: Coronavirus Is NOT America's Biggest Problem

We have a bad situation in America. No, I'm not talking about Coronavirus per se, I'm talking about the problem that many of us have known about for a while... a problem that Coronavirus has simply laid bare:

I'm talking about, in part, the complete breakdown of trust among different societal factions. This isn't a result of Coronavirus, it's a problem that Coronavirus is simply exposing more plainly, for all to see.

I've been noticing it more and more, because some people with whom I often agree are suddenly giving advice that I very much disagree with -- and I know exactly WHY they're doing it (and I understand it).

But let's start with what I DO agree with: Panic is never the correct response to anything. Emotion clouds judgment. Panic is a strong emotion, and as such leads to stupid decisions.

It is to your benefit to avoid panic in any stressful situation.

And I'm not speaking theoretically here. I've lived through my share of serious personal crises, as anyone who's read my sidebar piece (titled: Some of Pretzel's Unique Real-Life Experiences) knows. I've been mortally wounded and have faced the prospect of my own death. I've watched loved ones die in front of my eyes. I've been through other dire situations not discussed in that piece.

I haven't led "an easy life" by any means; I have been pushed to the edge by forces beyond my control, and I have been forced to stare into the abyss, against my will, for long, unbroken moments.

As a result, I like to believe I have a solid sense of perspective on life itself.

So yes, I agree that panic is worse than useless; it is a counterproductive emotion. Even if I knew for a fact that the Earth was going to collide with the Sun tomorrow, I still would NOT panic. I would set about trying to enjoy the little time we have left. I don't do "panic." Period.

(While writing this, I'm reminded of an old Buddhist parable my father was fond of: The Monk and the Strawberry -- about living in the present moment and remembering to enjoy it and be thankful, even in the most dire circumstances.)

Anyway, I feel all this is important to mention, because I've seen some people conflating reasonable caution with "panic," and thus belittling anyone who advocates any degree of caution. But these are not the same thing.

Let me give an analog that is similar, yet an order removed, for clarity: I live in Hawaii, and we've had our share of "false alarm" tsunami warnings over the years. In the past 10 years, I can think of at least three. Each time, the authorities warned us of a potentially-devastating tsunami, due to strike within hours.

Yet each time, basically nothing happened.

Does that mean that nothing will EVER happen? Of course not. Tsunamis are real things, and they do SOMETIMES happen. Therefore, while I never panic over tsunami warnings, I do consult a brief checklist to make sure our supply of canned goods and water is sufficient, and so forth.

Yet I also recognize that the more false alarms there are, the more dangerous the situation becomes. Not externally, but internally: Human nature leads us to become increasingly complacent with each additional false alarm. ("Oh, great, another tsunami warning. Yeah right!")

The first time you hear a tsunami warning, you are motivated to take action out of fear.

Then nothing happens... so the second time you hear a tsunami warning, you are motivated to take action out of prudence.

Then nothing happens AGAIN... so the third time you hear a tsunami warning, the only thing that keeps you action-oriented is discipline.

To assume every warning is going to end in a false alarm is magical thinking. Tsunamis exist, therefore the reality is that, EVENTUALLY, one will actually hit -- no matter how many false alarms we have to endure beforehand.

We thus have to treat each tsunami warning THE SAME in terms of taking prudent action, even though the majority of those warnings will be false.

In the absence of fear to motivate us, we must take action purely out of discipline.

It's not unlike trading, in this regard.

We likewise know from history that pandemics are real and -- just like our tsunamis here in Hawaii -- we must likewise realize that one will eventually hit.

To pretend nothing will ever happen is no different than panicking. They are flip sides of the same "extreme" coin. The response of "panic" and the response of "complete denial" are, for all practical intents and purposes, THE SAME RESPONSE.

One must find the middle path, where one takes reasonable precautions, yet one does not give into the herd impulse to stampede.

I am laying this all out because many are assuming that COVID-19 is simply "media hype" or similar. And I can't say I blame them, because the media has brought this upon themselves.

When our volcano here in Hawaii erupted a couple years ago, the national media got MOST of the coverage wrong. I spent many hours in the comments section at YouTube, correcting reports from CNN, NBC, et al, all of which gave facts that were SO FAR OFF it was mind-numbing. At one point, a CNN anchor said something to the effect of: "The island is completely overrun with lava!" As if I would have to dodge lava bombs on my way to the grocery store.

In reality, we could BARELY tell anything was happening where we lived, and even then, only if we drove a few miles to the side of the mountain where we had a clear view of the nighttime glow, which itself was many more miles distant. The eruption impacted just a tiny portion of Hawaii's land mass, along the order of 1%. If you drove maybe an eighth of the way across the island (which is a massive 4000+ square miles in size), you couldn't even tell an eruption was happening. It was business as usual outside the immediate eruption zone.

So I completely understand why some people assume COVID-19 is yet another media panic over nothing.

And because I know the news is a business that is required to sell advertising, which they have learned to do via sensationalism (sensationalism gets our attention, but often accomplishes the opposite of "informing" us), I even allow for the possibility that maybe I'm wrong; maybe it isn't as bad as I suspect.

This is the problem with years of "The Media Who Cried Wolf." When a real wolf finally DOES show up, nobody believes them anymore. They shot their credibility years ago, on all the pretend wolves they tried to get us to panic over.

This is part of the breakdown of trust that I'm talking about.

So it's partially a communication problem: We have no "national channels" that are universally trusted anymore. (In fact, as a general rule, the less you trust the media, the better off you are. As noted, this creates a big problem when a real "wolf" finally does show up, but there's not much we can do other than to demand higher standards from our news organizations and hope they can repair the bridges they have burned... but building trust takes time.)

The breakdown is partially political (neither side trusts the other to respond appropriately).

And it's partially a breakdown of trust in even the institutions that are supposed to be neutral. Our institutions of science and/or higher learning long-ago threw away the cloak of neutrality in exchange for partisanship -- and now many people no longer trust those institutions either. And quite understandably. Science still works, but when certain organizations have (quietly) abandoned universal ethics in favor of situation ethics, then science is no longer practiced at those organizations. Some people start to doubt "science," but really, science itself isn't the problem, the PEOPLE who are not doing honest science are the problem.

So my overarching point is: We have a near-complete breakdown of trust across multiple facets of society.

And Coronavirus is revealing this to be the massive problem that it is.

*****

So maybe this is what finally ends our decades-long run of prosperity. Not Coronavirus proper, but a society that, quite simply, can no longer function as a whole. No organization can function properly without trust. A marriage without trust is in dire straits. A business partnership without trust is doomed to fail.

A society without trust -- and thus without the ability to communicate efficiently -- cannot function cohesively. And a society without cohesion is not a "society" at all. It's a loose collection of factions, which lacks the bond required to get through the inevitable difficult times.

Loose collections of factions will splinter when faced with the slings and arrows of outrageous fortune.

We've become this weak in part because we are no longer united in a larger vision -- and the larger vision we have abandoned seems to be the quest for truth itself. Because while you and I may not agree on what, exactly, is correct -- if we are both committed, honestly, to finding the truth, then we are united by that larger vision, despite our individual disagreements.

We've forgotten (or choose to ignore) the reality that there is no "your truth" and "my truth." There is simply THE truth, and to the extent that either of us fails to align with it, then either or both of us are wrong -- and we will pay the price for our folly when we are crushed against objective reality.

Coronavirus isn't going to break society -- we have done that ourselves. We have done that by valuing partisanship over intellectual honesty. By valuing personal agenda over truth. And by behaving as though "the end justifies the means."

The end does not, and cannot ever, justify the means. A foundation built without a strong commitment to truth is no foundation at all -- because it contains within itself the seeds of its own destruction. A foundation without truth will always crumble under pressure. Because, ultimately, what is "truth"?

Truth is simply what is.

And that which is will always crush that which is not.

If I believe my Styrofoam raft is capable of weathering a massive oceanic storm, that may be "my personal truth," but it either is or is not objectively true. If it is not objectively true, then my Styrofoam raft will blow apart in the storm, and I will drown.

Truth is simply "reality, as it actually is."

Prior generations knew this. This wisdom has been learned not over decades, not over centuries, but over millennia. This is why every decent ancient source of wisdom values TRUTH above and beyond most other things.

Postmodernism, post-truth, etc. have gained much traction in recent years, because we want truth to be the equivalent of "personal opinion," when it simply isn't. It feels good when everyone is deemed to be "right" about whatever it is they believe, no matter how far off they may be. It might feel good to tell everyone they're correct about everything, but it's dangerous, because life is dangerous.

Knowing the truth helps keep us from walking off a cliff.

So it's high time for us to discard those outmoded and dangerous ways of thinking. In this sense, perhaps we should view Coronavirus as an opportunity. A warning for society that we desperately need to repair trust, across multiple platforms.

We can only repair trust if we commit to honesty in both seeking truth and in conveying that truth to others. Even when what we have to say it isn't what we "want" to be true. Even when the truth proves our prior beliefs wrong, or requires us to face personal embarrassment. Even if the truth isn't what other people want to hear, or requires us to endure mockery.

Because if we don't allow painful truths to crush us now, emotionally, then they will inevitably crush us later -- and not only emotionally, but in actuality.

Are we up to that challenge?

We had better be.

I'm talking about, in part, the complete breakdown of trust among different societal factions. This isn't a result of Coronavirus, it's a problem that Coronavirus is simply exposing more plainly, for all to see.

I've been noticing it more and more, because some people with whom I often agree are suddenly giving advice that I very much disagree with -- and I know exactly WHY they're doing it (and I understand it).

But let's start with what I DO agree with: Panic is never the correct response to anything. Emotion clouds judgment. Panic is a strong emotion, and as such leads to stupid decisions.

It is to your benefit to avoid panic in any stressful situation.

And I'm not speaking theoretically here. I've lived through my share of serious personal crises, as anyone who's read my sidebar piece (titled: Some of Pretzel's Unique Real-Life Experiences) knows. I've been mortally wounded and have faced the prospect of my own death. I've watched loved ones die in front of my eyes. I've been through other dire situations not discussed in that piece.

I haven't led "an easy life" by any means; I have been pushed to the edge by forces beyond my control, and I have been forced to stare into the abyss, against my will, for long, unbroken moments.

As a result, I like to believe I have a solid sense of perspective on life itself.

So yes, I agree that panic is worse than useless; it is a counterproductive emotion. Even if I knew for a fact that the Earth was going to collide with the Sun tomorrow, I still would NOT panic. I would set about trying to enjoy the little time we have left. I don't do "panic." Period.

(While writing this, I'm reminded of an old Buddhist parable my father was fond of: The Monk and the Strawberry -- about living in the present moment and remembering to enjoy it and be thankful, even in the most dire circumstances.)

Anyway, I feel all this is important to mention, because I've seen some people conflating reasonable caution with "panic," and thus belittling anyone who advocates any degree of caution. But these are not the same thing.

Let me give an analog that is similar, yet an order removed, for clarity: I live in Hawaii, and we've had our share of "false alarm" tsunami warnings over the years. In the past 10 years, I can think of at least three. Each time, the authorities warned us of a potentially-devastating tsunami, due to strike within hours.

Yet each time, basically nothing happened.

Does that mean that nothing will EVER happen? Of course not. Tsunamis are real things, and they do SOMETIMES happen. Therefore, while I never panic over tsunami warnings, I do consult a brief checklist to make sure our supply of canned goods and water is sufficient, and so forth.

Yet I also recognize that the more false alarms there are, the more dangerous the situation becomes. Not externally, but internally: Human nature leads us to become increasingly complacent with each additional false alarm. ("Oh, great, another tsunami warning. Yeah right!")

The first time you hear a tsunami warning, you are motivated to take action out of fear.

Then nothing happens... so the second time you hear a tsunami warning, you are motivated to take action out of prudence.

Then nothing happens AGAIN... so the third time you hear a tsunami warning, the only thing that keeps you action-oriented is discipline.

To assume every warning is going to end in a false alarm is magical thinking. Tsunamis exist, therefore the reality is that, EVENTUALLY, one will actually hit -- no matter how many false alarms we have to endure beforehand.

We thus have to treat each tsunami warning THE SAME in terms of taking prudent action, even though the majority of those warnings will be false.

In the absence of fear to motivate us, we must take action purely out of discipline.

It's not unlike trading, in this regard.

We likewise know from history that pandemics are real and -- just like our tsunamis here in Hawaii -- we must likewise realize that one will eventually hit.

To pretend nothing will ever happen is no different than panicking. They are flip sides of the same "extreme" coin. The response of "panic" and the response of "complete denial" are, for all practical intents and purposes, THE SAME RESPONSE.

One must find the middle path, where one takes reasonable precautions, yet one does not give into the herd impulse to stampede.

I am laying this all out because many are assuming that COVID-19 is simply "media hype" or similar. And I can't say I blame them, because the media has brought this upon themselves.

When our volcano here in Hawaii erupted a couple years ago, the national media got MOST of the coverage wrong. I spent many hours in the comments section at YouTube, correcting reports from CNN, NBC, et al, all of which gave facts that were SO FAR OFF it was mind-numbing. At one point, a CNN anchor said something to the effect of: "The island is completely overrun with lava!" As if I would have to dodge lava bombs on my way to the grocery store.

In reality, we could BARELY tell anything was happening where we lived, and even then, only if we drove a few miles to the side of the mountain where we had a clear view of the nighttime glow, which itself was many more miles distant. The eruption impacted just a tiny portion of Hawaii's land mass, along the order of 1%. If you drove maybe an eighth of the way across the island (which is a massive 4000+ square miles in size), you couldn't even tell an eruption was happening. It was business as usual outside the immediate eruption zone.

So I completely understand why some people assume COVID-19 is yet another media panic over nothing.

And because I know the news is a business that is required to sell advertising, which they have learned to do via sensationalism (sensationalism gets our attention, but often accomplishes the opposite of "informing" us), I even allow for the possibility that maybe I'm wrong; maybe it isn't as bad as I suspect.

This is the problem with years of "The Media Who Cried Wolf." When a real wolf finally DOES show up, nobody believes them anymore. They shot their credibility years ago, on all the pretend wolves they tried to get us to panic over.

This is part of the breakdown of trust that I'm talking about.

So it's partially a communication problem: We have no "national channels" that are universally trusted anymore. (In fact, as a general rule, the less you trust the media, the better off you are. As noted, this creates a big problem when a real "wolf" finally does show up, but there's not much we can do other than to demand higher standards from our news organizations and hope they can repair the bridges they have burned... but building trust takes time.)

The breakdown is partially political (neither side trusts the other to respond appropriately).

And it's partially a breakdown of trust in even the institutions that are supposed to be neutral. Our institutions of science and/or higher learning long-ago threw away the cloak of neutrality in exchange for partisanship -- and now many people no longer trust those institutions either. And quite understandably. Science still works, but when certain organizations have (quietly) abandoned universal ethics in favor of situation ethics, then science is no longer practiced at those organizations. Some people start to doubt "science," but really, science itself isn't the problem, the PEOPLE who are not doing honest science are the problem.

So my overarching point is: We have a near-complete breakdown of trust across multiple facets of society.

And Coronavirus is revealing this to be the massive problem that it is.

*****

So maybe this is what finally ends our decades-long run of prosperity. Not Coronavirus proper, but a society that, quite simply, can no longer function as a whole. No organization can function properly without trust. A marriage without trust is in dire straits. A business partnership without trust is doomed to fail.

A society without trust -- and thus without the ability to communicate efficiently -- cannot function cohesively. And a society without cohesion is not a "society" at all. It's a loose collection of factions, which lacks the bond required to get through the inevitable difficult times.

Loose collections of factions will splinter when faced with the slings and arrows of outrageous fortune.

We've become this weak in part because we are no longer united in a larger vision -- and the larger vision we have abandoned seems to be the quest for truth itself. Because while you and I may not agree on what, exactly, is correct -- if we are both committed, honestly, to finding the truth, then we are united by that larger vision, despite our individual disagreements.

We've forgotten (or choose to ignore) the reality that there is no "your truth" and "my truth." There is simply THE truth, and to the extent that either of us fails to align with it, then either or both of us are wrong -- and we will pay the price for our folly when we are crushed against objective reality.

Coronavirus isn't going to break society -- we have done that ourselves. We have done that by valuing partisanship over intellectual honesty. By valuing personal agenda over truth. And by behaving as though "the end justifies the means."

The end does not, and cannot ever, justify the means. A foundation built without a strong commitment to truth is no foundation at all -- because it contains within itself the seeds of its own destruction. A foundation without truth will always crumble under pressure. Because, ultimately, what is "truth"?

Truth is simply what is.

And that which is will always crush that which is not.

If I believe my Styrofoam raft is capable of weathering a massive oceanic storm, that may be "my personal truth," but it either is or is not objectively true. If it is not objectively true, then my Styrofoam raft will blow apart in the storm, and I will drown.

Truth is simply "reality, as it actually is."

Prior generations knew this. This wisdom has been learned not over decades, not over centuries, but over millennia. This is why every decent ancient source of wisdom values TRUTH above and beyond most other things.

Postmodernism, post-truth, etc. have gained much traction in recent years, because we want truth to be the equivalent of "personal opinion," when it simply isn't. It feels good when everyone is deemed to be "right" about whatever it is they believe, no matter how far off they may be. It might feel good to tell everyone they're correct about everything, but it's dangerous, because life is dangerous.

Knowing the truth helps keep us from walking off a cliff.

So it's high time for us to discard those outmoded and dangerous ways of thinking. In this sense, perhaps we should view Coronavirus as an opportunity. A warning for society that we desperately need to repair trust, across multiple platforms.

We can only repair trust if we commit to honesty in both seeking truth and in conveying that truth to others. Even when what we have to say it isn't what we "want" to be true. Even when the truth proves our prior beliefs wrong, or requires us to face personal embarrassment. Even if the truth isn't what other people want to hear, or requires us to endure mockery.

Because if we don't allow painful truths to crush us now, emotionally, then they will inevitably crush us later -- and not only emotionally, but in actuality.

Are we up to that challenge?

We had better be.

Friday, March 13, 2020

Market Update: What's 6,000 Points Among Friends?

Yesterday, INDU captured its target zone -- good for an amazing 6,000 points in only 12 trading sessions (!).

So, accordingly, last night, I spent almost exactly an hour working on a SINGLE, detailed chart of the micro count, because we need to know if INDU could reconcile as a complete five-wave decline, to thus mark ALL OF C down. Then I clicked out of the chart on Stockcharts, selected "Yes" to save my work, and...

it didn't save.

I have no idea what actually happened to it, or why -- but there was my original, unaltered chart, smirking at me smugly, secure in the knowledge that it could never be defaced with labels and that my efforts were in vain. As if, instead of working my tail off sweating every detail, I had been a politician and done nothing.

Of course, this was around 8:25 p.m. local Hawaii time, and the market opens at 3:30 a.m. here (and I'm already WAY short on sleep since the mainland did its time change and pushed everything an hour earlier for us), so that, as they say, was that. I had no choice but to back away slowly from my computer, while cussing Stockcharts (and technology in general) to high Heaven. Despite my hopes, this cussing did NOT inspire Stockcharts to correct its mistake, and this morning, the chart remained as it had been last night: Unaltered, and still smirking at me.

I did not, do not, and will not have time to recreate it. Possibly ever, the way this market has been moving. It is lost forever in the sands of internet crapola.

Or something like that.

Anyway, the bottom line conclusion of that chart was that, yes, technically, we CAN resolve the move as a complete five-wave decline to thus mark ALL OF (C) -- but it would probably look slightly better with another new low (the last micro-wave was a little spotty and looks more like the b-wave low of an expanded flat than a complete impulse). But that's almost a toss-up, and given that we just captured 6,000 points in roughly two weeks, we probably shouldn't get too greedy here, but should instead focus on risk management.

It's also interesting to note that the Fed finally stepped in with a trillion dollars in Monopoly money to help the market feel like, "You know what, maybe Coronavirus is NOT going to end civilization as we know it, as least not today." And that they did so right at the Big (C) inflection point.

Funny how that works. Almost as if the charts lead the news (they do).

Anyway, let's look at three charts. It should be four charts, but missing from the party is, of course, the micro count, because presently the only copy that exists is in my head. Thanks, Stockcharts!

First up... raise your hand if you thought I was off my rocker when I initially proposed this count:

Yet here we are, with the bottom of A of (4) decidedly broken, and in the target/inflection zone for Wave (C).

And, as I mentioned earlier, while it might look slightly better with another new low, we probably shouldn't get too greedy. 6,000 points is a LOT to capture in roughly two weeks -- in fact, it's almost certainly some kind of record in absolute terms. So, as the song goes: "You gotta know when to hold 'em... know when to walk away..." and all that. We held 'em. Now may be time to count our winnings and capture/protect the lion's share of profits.

In fact, in actuality, we effectively caught this ENTIRE decline, because we were initially looking for a smaller c-wave off the all-time high (we were looking for about 1,600 points initially), then we captured that initial target and adjusted in real-time to the much lower target.

That's actually pretty incredible, when you stop to think about it. We're not perma-bears (and I do mean "we" collectively; not as in the royal we) who "finally got one right." We were bullish heading into the all-time high, then reversed footing and were likewise on the right side of this unprecedented decline the entire time. This move is one for the history books, and we are now among the tiny fraction of a percentage of traders who can say: Not only were we there, but we saw it coming.

We can be proud of that.

Now, this next chart is interesting. RSI is demonstrating a potential change of character for the market, for the first time since 2010:

So, does the above mean it's all over for the bull market? It can... but it's also not uncommon to see this type of move during the final highest-degree fourth wave:

And keep in mind that the above is MONTHLY RSI, and we're not even halfway through the current month, so things can change between now and March 31st (wait, are there 31 days in March? Or 30? "30 days hath September... all the rest, I can't remember." Isn't that how it goes? No matter! You get the idea.)

Anyway, RSI could be signaling that we're on the final leg of the bull (which is what I have suspected for a while -- just been waiting for us to FINALLY get done with this (apparent) complex fourth wave). And keep in mind that "final leg of the bull" can run for several years.

Or, to be a party pooper, maybe things are more serious than that -- we'll just have to see how it goes from here... but I suspect the Fed and the world's Central Banks/governments can still produce at least "one last hurrah" before the system runs out of hurrahs. We're seeing some cracks now, and we're being reminded that, ultimately, the Universe consists of forces much larger than printing presses and monetary stimulus. We've had such a long, generational run, that we've forgotten there are tides and currents over which we have exactly zero control -- and there are problems which cannot simply be "printed over" with fiat currency.

Coronavirus is our early reminder of this fact. For those whose eyes are open.

In conclusion, INDU has reached the target/inflection zone, but would probably look a LITTLE better with another new low, though this is not required. Instead of pushing our luck here, we should be taking a victory lap and limiting our risk. Trade safe.

So, accordingly, last night, I spent almost exactly an hour working on a SINGLE, detailed chart of the micro count, because we need to know if INDU could reconcile as a complete five-wave decline, to thus mark ALL OF C down. Then I clicked out of the chart on Stockcharts, selected "Yes" to save my work, and...

it didn't save.

I have no idea what actually happened to it, or why -- but there was my original, unaltered chart, smirking at me smugly, secure in the knowledge that it could never be defaced with labels and that my efforts were in vain. As if, instead of working my tail off sweating every detail, I had been a politician and done nothing.

Of course, this was around 8:25 p.m. local Hawaii time, and the market opens at 3:30 a.m. here (and I'm already WAY short on sleep since the mainland did its time change and pushed everything an hour earlier for us), so that, as they say, was that. I had no choice but to back away slowly from my computer, while cussing Stockcharts (and technology in general) to high Heaven. Despite my hopes, this cussing did NOT inspire Stockcharts to correct its mistake, and this morning, the chart remained as it had been last night: Unaltered, and still smirking at me.

I did not, do not, and will not have time to recreate it. Possibly ever, the way this market has been moving. It is lost forever in the sands of internet crapola.

Or something like that.

Anyway, the bottom line conclusion of that chart was that, yes, technically, we CAN resolve the move as a complete five-wave decline to thus mark ALL OF (C) -- but it would probably look slightly better with another new low (the last micro-wave was a little spotty and looks more like the b-wave low of an expanded flat than a complete impulse). But that's almost a toss-up, and given that we just captured 6,000 points in roughly two weeks, we probably shouldn't get too greedy here, but should instead focus on risk management.

It's also interesting to note that the Fed finally stepped in with a trillion dollars in Monopoly money to help the market feel like, "You know what, maybe Coronavirus is NOT going to end civilization as we know it, as least not today." And that they did so right at the Big (C) inflection point.

Funny how that works. Almost as if the charts lead the news (they do).

Anyway, let's look at three charts. It should be four charts, but missing from the party is, of course, the micro count, because presently the only copy that exists is in my head. Thanks, Stockcharts!

First up... raise your hand if you thought I was off my rocker when I initially proposed this count:

Yet here we are, with the bottom of A of (4) decidedly broken, and in the target/inflection zone for Wave (C).

And, as I mentioned earlier, while it might look slightly better with another new low, we probably shouldn't get too greedy. 6,000 points is a LOT to capture in roughly two weeks -- in fact, it's almost certainly some kind of record in absolute terms. So, as the song goes: "You gotta know when to hold 'em... know when to walk away..." and all that. We held 'em. Now may be time to count our winnings and capture/protect the lion's share of profits.

In fact, in actuality, we effectively caught this ENTIRE decline, because we were initially looking for a smaller c-wave off the all-time high (we were looking for about 1,600 points initially), then we captured that initial target and adjusted in real-time to the much lower target.

That's actually pretty incredible, when you stop to think about it. We're not perma-bears (and I do mean "we" collectively; not as in the royal we) who "finally got one right." We were bullish heading into the all-time high, then reversed footing and were likewise on the right side of this unprecedented decline the entire time. This move is one for the history books, and we are now among the tiny fraction of a percentage of traders who can say: Not only were we there, but we saw it coming.

We can be proud of that.

Now, this next chart is interesting. RSI is demonstrating a potential change of character for the market, for the first time since 2010:

So, does the above mean it's all over for the bull market? It can... but it's also not uncommon to see this type of move during the final highest-degree fourth wave:

And keep in mind that the above is MONTHLY RSI, and we're not even halfway through the current month, so things can change between now and March 31st (wait, are there 31 days in March? Or 30? "30 days hath September... all the rest, I can't remember." Isn't that how it goes? No matter! You get the idea.)

Anyway, RSI could be signaling that we're on the final leg of the bull (which is what I have suspected for a while -- just been waiting for us to FINALLY get done with this (apparent) complex fourth wave). And keep in mind that "final leg of the bull" can run for several years.

Or, to be a party pooper, maybe things are more serious than that -- we'll just have to see how it goes from here... but I suspect the Fed and the world's Central Banks/governments can still produce at least "one last hurrah" before the system runs out of hurrahs. We're seeing some cracks now, and we're being reminded that, ultimately, the Universe consists of forces much larger than printing presses and monetary stimulus. We've had such a long, generational run, that we've forgotten there are tides and currents over which we have exactly zero control -- and there are problems which cannot simply be "printed over" with fiat currency.

Coronavirus is our early reminder of this fact. For those whose eyes are open.

In conclusion, INDU has reached the target/inflection zone, but would probably look a LITTLE better with another new low, though this is not required. Instead of pushing our luck here, we should be taking a victory lap and limiting our risk. Trade safe.

Wednesday, March 11, 2020

INDU (and SPX by Proxy): Early Warning of Inflection Zone

Last update saw the fourth wave count confirmed and saw the market enter a 7% down trading halt for the first time in years. We then bounced briefly, before making (by pennies) another new low yesterday -- and bouncing again. We appear to be working on a complex fourth wave at lower degree (a complex fourth within the fifth wave decline from the prior fourth, if you follow). This suggests that another new low may still be needed to resolve things.

In fact, it's possible we'll get a new low, whipsaw directly and run back above yesterday's high, then whipsaw again and make another new low. This is one possibility that's suggested by the charts at the moment, so keep alert to that.

That said, we are getting into territory that should generate at least a bit of caution from bears. This is "bounce or break" terriroty -- either the market will behave as it has for the past decade and bounce soon... or we will have a true change of character for the first time since 2009:

On the big picture chart, we have entered into the inflection zone for the bullish "c of 2" count, which could be triggered by either massive stimulus, or a COVID-19 vaccination.

In conclusion, near-term, the market still appears that it probably needs another new low, possibly two more (in the form of a complex correction). Bigger picture, we are into a (fairly wide, though not in relative terms) inflection zone. Note that I fully expect I may be a bit early in warning of this, but such is my nature (and kind of the point, I think!). Trade safe.

In fact, it's possible we'll get a new low, whipsaw directly and run back above yesterday's high, then whipsaw again and make another new low. This is one possibility that's suggested by the charts at the moment, so keep alert to that.

That said, we are getting into territory that should generate at least a bit of caution from bears. This is "bounce or break" terriroty -- either the market will behave as it has for the past decade and bounce soon... or we will have a true change of character for the first time since 2009:

On the big picture chart, we have entered into the inflection zone for the bullish "c of 2" count, which could be triggered by either massive stimulus, or a COVID-19 vaccination.

In conclusion, near-term, the market still appears that it probably needs another new low, possibly two more (in the form of a complex correction). Bigger picture, we are into a (fairly wide, though not in relative terms) inflection zone. Note that I fully expect I may be a bit early in warning of this, but such is my nature (and kind of the point, I think!). Trade safe.

Monday, March 9, 2020

SPX and INDU: Counts Confirmed, but It Brings No Joy

Futures are limit down tonight, and oil crashed (again). Neither of these things come as a surprise here -- on the forum, I posted on Friday that it was high probability Friday's low would fail directly, and that we could see a large gap down on Monday (the market created a glaringly-obvious b-wave low during Friday's session).

I haven't updated my oil forecast in a year because there's been no change -- my standing count has been that the last crash was the bottom of wave 3 and that a new low was likely still needed. I first called the top in oil back in 2011, when oil was still trading over $100, and gave a price target of $25, which everyone thought was insane -- but here we are now nearly 9 years later, and the "smartest guys in the room" have finally caught up:

Welcome to the party, I guess.

Incidentally, I called the bounce from 26 to 55, then adjusted my target higher in real-time to 70-72, then called the secondary top in oil as well (I was a little early, but within 4 points), back in May of 2018. Considering Goldman Sachs apparently missed the top by around 40 points in the wrong direction, I consider that pretty good. For posterity, here's the last chart I published on oil, in 2018 (it's marked 2019 because, while I can read a chart, I apparently can't read a calendar):

All of this begs the question: Why isn't Goldman paying me an 8 figure salary? We may never know. But what we do know is that the system is going to be getting very stressed now.

And all of this has left me in a pensive mood. I have three children; my oldest is in her first year of college. My youngest is still in grade school. And the system is garbage. We all know it. We've all known it for years. But the endless cycle of debt and booms and busts has, more or less, worked for the past 50 years. The problem is, those have been 50 REALLY GOOD YEARS, in terms of humanity's struggles. We haven't faced any true existential crises in that time. We haven't faced extinction-level event asteroids, or massive solar flares, or, say, a killer virus that spreads before symptoms are present.

In fact, we've become so spoiled by these prolonged good and prosperous times that we have to invent pretend crises, and the politicians repeat them every election cycle. "Oh, the climate crisis, yada yada." Apparently these people have never looked at the long-term climate of Earth long enough to learn that we are in living in one of the most stable and life-conducive climates of the past several hundred thousand years. I mean, the end of the last glacial maximum was only ~21,000 years ago, and since then, sea level has risen 400 feet. But, of course, if it rises another few inches in the next century, we're all going to die (insert "rolleyes" emoji here).

Even short-term, one doesn't need to look back very far (in geological time) to find TRUE climate crises:

Anyway, don't get me sidetracked into this, because I've studied climatology for the past two decades and have literally hundreds of gigabytes of peer-reviewed scientific papers and historical weather data stored on my hard drives, so I could probably write a book on it at this point. Suffice to say that most what you hear on the news is NOT science, it's hype and superstition designed to get your attention and sell advertising -- it is not designed to inform you in any way, shape, or form. Most of it is not even mainstream science.

The point I'm getting at is that humans, when they have no true struggles, tend to invent pretend struggles. It seems to be in our nature to make our own lives seem difficult -- like we don't believe we deserve our lives to be without struggle.

And we've had a long, long stretch of prosperity to the point that few people alive today have (as a collective, not individually) known struggle the way, say, the generations that fought World War II, and lived through the Great Depression did.

And my larger point with all this is that -- during this extended run of prosperity -- we've invented "new" systems that work DURING THE GOOD TIMES. These systems have not been tested in bad times.

These systems will fail in bad times. Again, many of us have known this for years -- but try telling the guy who's hitting jackpot after jackpot on the slot machine that if he keeps at it, he's going to lose all his money. He won't listen -- not as long as the jackpots keep rolling in.

We're stupid that way.

Anyway, I got to thinking about all this because my long-term count has us approaching the end of Cycle Wave 5 -- and the end of Cycle 5 marks the end of a higher degree Supercycle Wave.

And the end of Supercycle rallies is a huge deal. It's world-changing. By my count, even the Great Depression was only at Cycle degree. Imagine something an order of magnitude worse, and you have Supercycle degree.

I don't think we're there yet (I actually have the year 2025+/- as the window). But what's going on now got me thinking. More in another update, perhaps. Let's look at the charts.

First up, the near-term count that Wave 4 (or Wave A of 4) had completed will be confirmed at the open:

Higher degree:

An even longer-term look, this time in log scale:

And a similar chart, for SPX, which has a better channel -- and a brief discussion on Cycle 4 and 5:

Finally:

In conclusion, there's not much for bulls to grab onto here yet. C down is still unfolding, and could even have much farther to run. Do keep in mind that this is projected to be Wave 5 (since we just had Wave 4) -- so if it doesn't extend, it could complete a higher degree waveform, which could either mark the bottom of (larger) Wave 1 of C, or ALL OF C (for the alternate bull count). Trade safe.

Friday, March 6, 2020

SPX and INDU: No Material Change

Last update expected we were at or near the end of a complete wave, and it appears that was correct. The question now is whether that peak will mark the end of Wave A of 4 or ALL OF 4. My gut instinct is that it's Wave A of 4 and that we will retest the zone near the swing low (plus or minus), then form a second rally leg, but it's hard to say if support will materialize during waterfall decline waves, so we'll simply have to play it by ear.

This chart has proven handy, with SPX's break of the median leading to the projected bounce, and that bounce now retracing. Past breaks have led to more sideways action before heading toward the channel bottom, so the overall bounce may not be done yet:

Finally, SPX stalled after back testing the broken channel:

In conclusion, no material change since last update. SPX has likely either completed ALL OF Wave 4, or completed Wave A and is working on Wave B now. I'm leaning toward this being Wave B (or Wave 2 of the alternate bull count) with another rally leg to follow, but this "ain't exactly your father's market," so we shall see. Note that SPX will be testing a possible support zone right at the open today, so we'll be watching to see how it handles that. Trade safe.

This chart has proven handy, with SPX's break of the median leading to the projected bounce, and that bounce now retracing. Past breaks have led to more sideways action before heading toward the channel bottom, so the overall bounce may not be done yet:

Finally, SPX stalled after back testing the broken channel:

In conclusion, no material change since last update. SPX has likely either completed ALL OF Wave 4, or completed Wave A and is working on Wave B now. I'm leaning toward this being Wave B (or Wave 2 of the alternate bull count) with another rally leg to follow, but this "ain't exactly your father's market," so we shall see. Note that SPX will be testing a possible support zone right at the open today, so we'll be watching to see how it handles that. Trade safe.

Subscribe to:

Posts (Atom)