Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Friday, September 25, 2020

SPX Update: Target 1 Captured

Wednesday, September 23, 2020

SPX Update: Hmm

Monday, September 21, 2020

SPX Update: Bear Lean Proves Correct

Last few updates noted I was leaning toward the bear counts by a slim margin, and Friday's action (plus today's pending gap down open) will validate that lean.

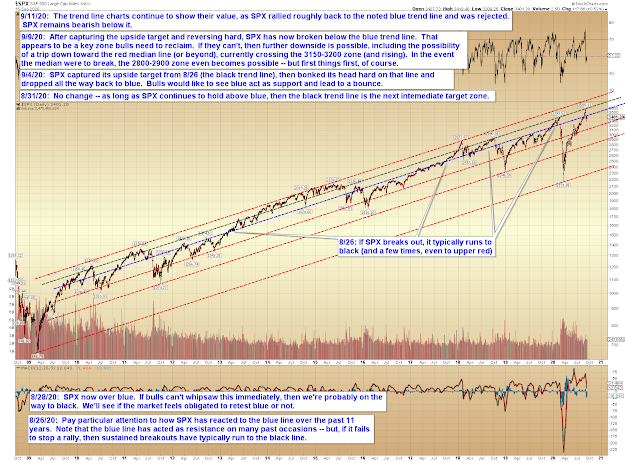

It also turns out that SPX's break back below the blue pivot on the daily chart below, noted a couple weeks ago (and several times since), was in fact as significant as it appeared at the time:

The targets suggested by that chart appear to line up reasonably well with a classic "C=A" target based on the current wave counts:

OEX proved to be a good canary (not much to say about it beyond noting that, as OEX and SPX tend to track together pretty well):

Finally, the hourly trend line chart has also been in agreement with the daily chart (and with the current counts), and proved particularly valuable for nailing the top on Wednesday:

Frankly, given how bastardized this market is (with the endless Fed intervention), I'm a little surprised myself at how well all these charts have worked over the past month.

In conclusion, the previously-slightly-favored bear count has come/is coming to pass -- the next question the market will need to answer will be the question of whether bulls can hold the decline at an ABC, or if bears can turn this decline into a larger impulse, which would indicate a bigger trend change that could run into the election or beyond. In both cases, more downside appears to be needed for the near-term. We'll tackle that next question as the pattern develops. Trade safe.

Friday, September 18, 2020

SPX and OEX Update

On Wednesday, Jerome Powell took questions from high school students while standing in his basement in front of a blue curtain and wearing a tie that experts agree "was probably best described as some shade of purple or lavender or something." He used the word "tools" (by my count) upwards of 27,000 times, which shocked the market into a brief tailspin. (Purple is, of course, the tie color that -- when combined with the term "tools" -- triggers that type of action, as I think most of us already knew.)

Powell then promised (and here I'm quoting directly) "to do everything in his Powell" (he loves this pun, even though most of us are sick of it by now) "to assure that the Fed will use its tools, which at this point consist solely of a giant printing press, to print money until the cows come home to roost."

So we all know this will end really well for America. But enough tomfoolery. On to the charts!

First up, last update noted that I was favoring the bears, and that worked out well for the short-term. I had noted previously that a break above the upper red line should take SPX north of 3425, and on Wednesday, that zone was reached, which cleared bears to take over. And take over they did, at least for the near-term:

And OEX suggests that even if bulls can put together a near-term bounce here, the market might still be drawn back to current lows:

In conclusion, I continue to give the slight edge to bears, but it's not impossible for SPX to put in another leg up before resolving anything. Trade safe.

Wednesday, September 16, 2020

SPX Update: IMPORTANT! Watch Jerome Powell's Tie! (And Two Potential Counts)

Monday, September 14, 2020

See Last Piece for the Market Update -- This One is About Cognitive Bias

“He who knows only his own side of the case knows little of that. His reasons may be good, and no one may have been able to refute them. But if he is equally unable to refute the reasons on the opposite side, if he does not so much as know what they are, he has no ground for preferring either opinion... Nor is it enough that he should hear the opinions of adversaries from his own teachers, presented as they state them, and accompanied by what they offer as refutations. He must be able to hear them from persons who actually believe them...he must know them in their most plausible and persuasive form.”

― John Stuart Mill, On Liberty

- The truth of where the mines are located, or

- a belief system that may "sound better" but which is going to get you blown up directly?

- An easy-to-read map that shows you how to get safely through the entire minefield, or

- A map that shows you the first three safe steps, then gives vague hints on how to figure out the next step from there?

- Do we want our beliefs to flow from (and thus be based upon) truth?

- Or, the alternative: Do we want our "truths" to filter down from (and thus be based around) our beliefs?

- It's very valuable for traders to be aware of this tendency in themselves.

- I'm going to refer back to it in future articles, some of which may (will) go beyond trading.

SPX Update: Key Inflection Zone

I started writing a piece about bias, as bias is always relevant in trading (and in life), which I intended to include in today's update, but I couldn't quite get it finished in time for the open -- so keep an eye out for it to be published later today or tomorrow.

Market-wise, SPX has now formed a pattern that could be significant:

Bigger picture, SPX remains below first key resistance:

Friday, SPX was unable to break out of the near-term downtrend channel. Futures suggest it will try again at today's open:

In conclusion, SPX is in a pattern inflection zone, and as simply as possible: Bulls need to put a bounce together here. Much lower and they could face a significant decline. Trade safe.