Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Wednesday, December 28, 2022

SPX Update

Wednesday, December 21, 2022

SPX Update: Inflection Target Captured

Monday, December 19, 2022

Brief Update: Three Waves Down

Friday, December 16, 2022

SPX, INDU, BKX: To B or Not to B

Wednesday, December 14, 2022

SPX, INDU, and TLT Updates

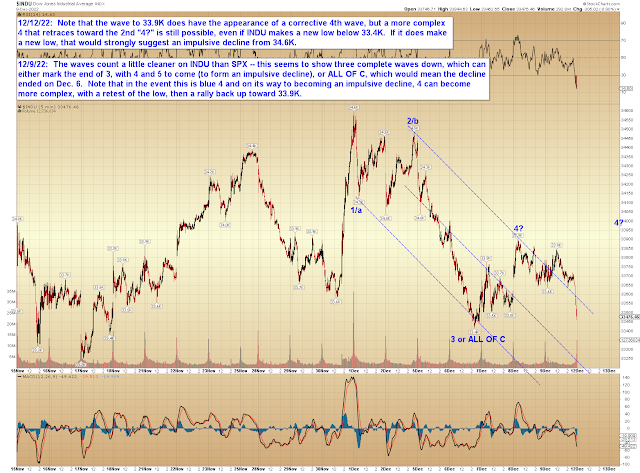

Monday, December 12, 2022

INDU and SPX: A Little More Detail

Since last update, while the market has technically done nothing, INDU has continued its rejection from the first blue 4 inflection:

I added some detail to the SPX chart, since I don't want the straight line pointing downward to be taken as an actual nuanced projected path. SPX does not need to follow the exact path shown below and probably won't, but this is more reasonably representative of the type of path SPX could take if we have already seen the start of blue 3:

In conclusion, no change from last update, and we remain on the cusp of an impulse. Trade safe.