Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm from the author who first coined the term "QE Infinity." Published on Yahoo Finance, NASDAQ.com, Investing.com, etc.

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Friday, March 17, 2023

SPX Update

Wednesday, March 15, 2023

SPX, BKX, NYA Updates

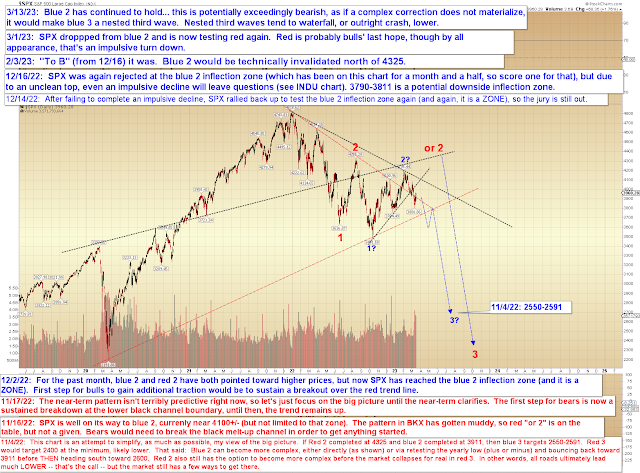

Since last update, SPX captured its 3820-45 target (from March 8), exceeded it by about 10 points, then bounced. That's potentially 3 waves up off the 3808 low (to 3937), so bears can take it back below 3808 from here if they want.

Given where we are in the big picture, this is market is very possibly hanging by a thread, so countertrend trading (i.e.- bullish trades) should be kept on a very tight leash unless and until there are more bull signals. The most bearish case is that we've already entered Blue 3 -- and frankly, there's nothing currently in the charts to suggest otherwise. That can, of course, always change tomorrow, but this is what's in front of us right now.

Probably the front-runner for the "bull" options (not long-term bullish) would be the expanded flat discussed on March 1:

One can at least envision a world where the Fed announces at its upcoming meeting it's going to pause rate hikes and the market gets excited, leading to the option above.

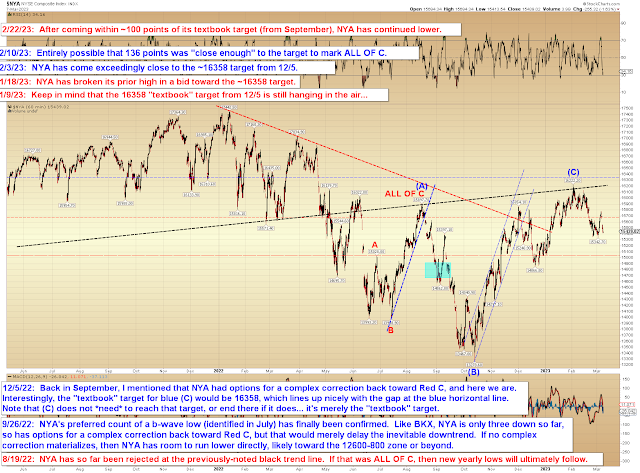

NYA has continued to track SPX:

And finally, we haven't update BKX in a while, but it has confirmed my long-term bearish outlook and finally officially captured its 90 target from way back on May 1, 2022 (bottommost annotation). Also, I'm getting flashbacks to the 2008 bear, where BKX often led the way down:

In conclusion, we can come up with a scenario where BKX completes the blue 5 potential and SPX runs the expanded flat (2nd chart), but those are best-case bull scenarios, and the worst-case bear scenario is a third wave waterfall lower that erases 1400-1500 points from SPX's current levels. In both cases, the long-term outlook remains bearish, as it has for over a year now. Trade safe.

(Incidentally, I published another piece earlier this morning: Why? Because It's Really Important)

Tuesday, March 14, 2023

Why? Because It's Really Important

(Note: SPX will be covered in the next update, later today.)

Before I start, I'd like to clarify something about Monday's update: When I said that SVB's collapse can be laid at the feet of the Fed, I didn't mean to imply (by omission) that SVB management is entirely blameless. Of course SVB's missteps also played a role. I felt that was self-evident, so my point was that when the Fed fills a room with gasoline, you don't solely blame the guy who struck the match when the whole place goes up in flames.

You blame them both. Because both parties acted irresponsibly. And, in this case (and most cases that are still to come) you can't have one party blow up without the other party setting the stage.

Before we forget... the stage, as set by our leaders, was:

- The Fed kept rates too low for too long, which created numerous asset bubbles

- The Fed pumped $8 trillion of QE into the market, which created numerous asset bubbles

- The Fed and Federal Government flooded the economy with stimulus, thereby diluting the value of existing dollars and contributing to inflation

- Both the Fed and the government failed to even foresee the looming inflation (remember "it's just transitory"?)

- They failed to foresee it because they operate from a flawed philosophy (Keynesianism)

- They then had to abruptly stop the free money party and reverse course.

And through all that, we've learned this: The problems never seem to come while the Fed is running the pumps; the problems come afterwards. Everything booms when the cheap money is flowing -- but this "false boom" is, in fact, exactly what plants the seeds for the future bust. It seems to be an endless cycle of the current Keynesian economic policies.

So no, it wasn't "deregulation" (as some are now claiming) that set the stage -- otherwise, how could I have seen it coming before that deregulation even happened? The stage is much more complex than that. In fact, the complexity of the environment is exactly what makes simplistic one-word narratives ("deregulation!" etc.) so appealing for our leaders to deploy against a population that doesn't have the time to dig deeper.

For Monday's piece, I chose to focus on the role of the Fed/gov't instead of SVB because (in theory, anyway) we're supposed to be able to course-correct our own government. (Though many of us feel this is an increasingly futile effort.)

I wanted to clarify that -- but please bear with me a moment longer, because I believe this is important.

Last update predicted:

So ultimately, [SVB] is yet another collapse that can be laid at the doorstep of the core Keynesian philosophy (top-down central "management" of the economy) that has long captivated and motivated the leaders of our institutions. As the trouble snowballs, you'd better believe they will not want to take the blame for any of it -- so the history-rewrites and propaganda will start any minute, if they haven't already.

That prediction has, unfortunately, since come to pass. Because luckily for America, the Fed and the government have never ever made mistakes or mismanaged the economy, and thus not one single problem has ever been their fault. Quite the opposite, as it turns out! The fault, we're always told, is actually that those entities were given too little control.

Kind of a win-win for the powers that be, when you think about it. Even when they monumentally screw things up, they simply point the finger elsewhere and claim it's because what they really needed was even more power to screw things up.

You may be under the impression that I'm beating a dead horse here -- I am not. I was around before, during, and after the 2008 crash. In 2008, I diagnosed the problems before the crash happened (as did many others), then carefully observed those problems catastrophically unwind in real-time... and then watched the Fed and our government tap-dance right out of taking any significant blame for the bubbles and problems they themselves created.

And this is exactly why we're doing it all over again.

Because no real accountability ever occurred, since most of the public remained blissfully unaware, and hence no lessons were ever learned, and no core changes were ever made. And that was only possible because the general public was effectively duped into believing it was 100% the fault of everyone BUT the Fed/gov't. So, when the 2008 crash was all over, we passed banking laws that addressed the symptoms but completely ignored the disease.

I'm going to try to do my part to help keep people from falling for it again this time around. If we want to have any hope of rebuilding on solid ground, then we'd damn well better learn the real, and painful, lessons this time. Not the false "lessons" they spoon-feed us.

Speaking of, let's quickly glance at a few "charts," to see how Monday's prediction of "immediate blame-shifting propaganda incoming" fared:

And that's just a smattering of the propaganda that's been rolled out since I published on Monday. I could have posted a dozen more.

Trade safe.

Monday, March 13, 2023

SPX and NYA Updates

My personal theory is that the Fed won't bail out the market until it's too late and too much damage has already been done. I base this speculation largely on the charts, but even if I had no charts, I would probably speculate the same thing, because the Fed always overshoots, in both directions. Thus, I suspect that by the time the Fed tries to reverse course, it will be too late to stop several large entities from collapsing under the pressure (the market is not ready for this environment, and most humans do not adapt to change quickly enough to make the adjustments they will need to make to save their organizations).

SVB collapsed because it did not adapt to the changing conditions quickly enough and was caught wrong-footed on Treasuries. Which crashed because the Fed had to hike rates quickly, which it had to do because inflation was (/is) out of control, which in turn happened because the Fed and the US Government both printed way too much free and easy money for way too long.

Remember that when these same entities who have completely mismanaged our economy try to shift the blame elsewhere by insisting that they (yes, the very same government that caused the problems!) could have stopped this (and the rest of what's coming) if only they'd had even more control/"regulation."

This is akin to an arsonist insisting that he could have saved a building that he himself lit on fire -- if only he'd been allowed to light even more fires.

So ultimately, this is yet another collapse that can be laid at the doorstep of the core Keynesian philosophy (top-down central "management" of the economy) that has long captivated and motivated the leaders of our institutions. As the trouble snowballs, you'd better believe they will not want to take the blame for any of it -- so the history-rewrites and propaganda will start any minute, if they haven't already. After all, if the masses ever figured out the game, voters might wake up and start demanding the government relinquish some of its control, and we can't have that.

If you can't tell, I get a bit upset when I think about what they've done to our country, and I get even more upset when they obfuscate it. If the public continues to be misdirected into blaming the wrong things, nothing will ever get better. It will only get worse... and unfortunately, that's the path we seem to be on.

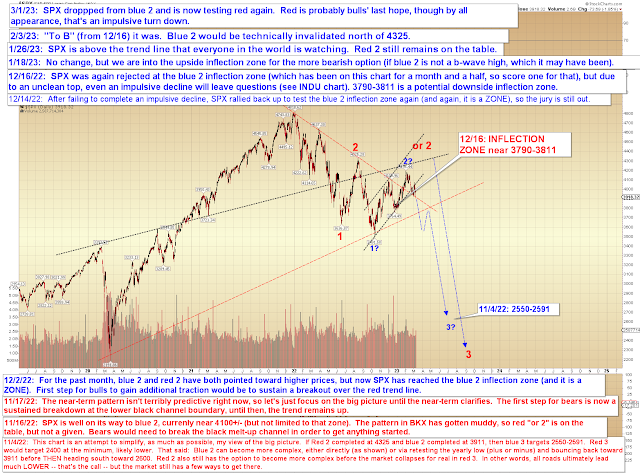

Let's get to the charts. Last Wednesday, I wrote:

Bear v, were it to materialize directly, only needs to break the low at 3928, but if it can sustain a breakdown there, then 3820-45 would certainly be within the range of possibility for bear v.

SPX came within a point of that target on Friday, and should reach it at the open today:

Big picture, blue 2 is, of course, still very much on the table:

NYA remains in lockstep with SPX:

In conclusion, it's finally starting to feel like the market is waking up to the realities that we've been discussing here for over a year now. There are still options for complex second waves here (variations on Red 2 on the second chart), but for now, the trend is our friend, and we won't discuss those in more detail until the market gives us reason to. Do keep in mind that SPX will reach its first downside target zone, so a bounce soon is not out of the question. Trade safe.

Friday, March 10, 2023

NYA and SPX: Another Hit

Wednesday, March 8, 2023

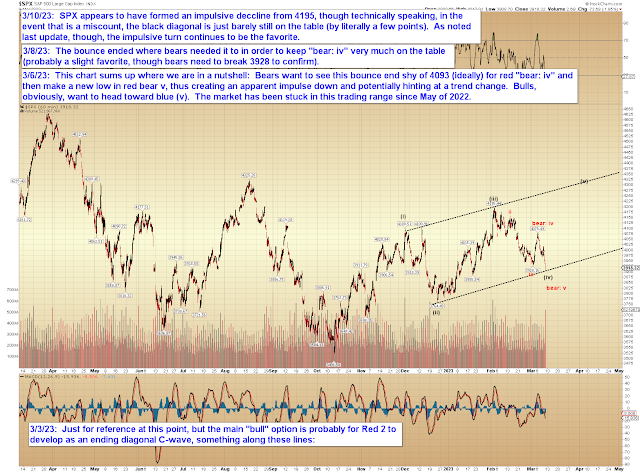

SPX and NYA Updates: Bears Got What They Needed So Far

In the last update, I wrote: If the current rally is a micro fourth wave, then bears would probably like to see it end shy of 4093. (There's a gap near 4070, we'll see if the market wants to aim for that or not.)

Monday, March 6, 2023

SPX Update: 10 Months in Purgatory

SPX did officially capture the red trend line, so it can bounce up to break last month's high from here, or it can bounce in a small fourth wave and then go on to form a fifth wave, which would give us a larger impulse down.