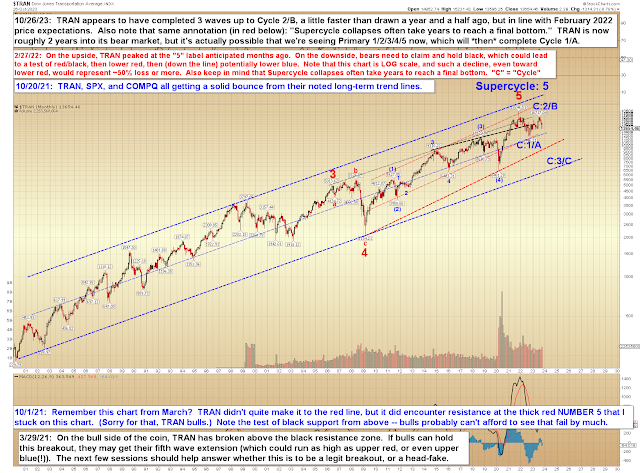

On Friday, SPX captured its preferred target zone for Wave 5 of 3/C, so it's entirely free to bounce in a decent reaction rally now. But -- just in case -- because we're into potential "crash window" territory (not something I say often), today we're also going to discuss some of the "But what if it's not that simple?" options.

Let's start with NYA, which has behaved like a champ (at least, if one has been following the ongoing targets and wave counts listed in these updates, it has):

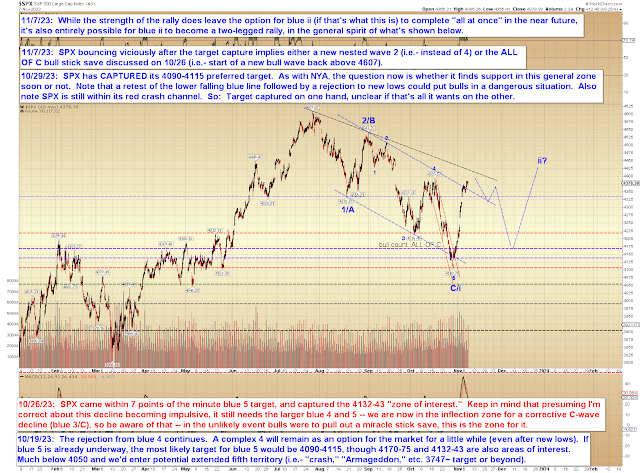

Next, we'll look at SPX:

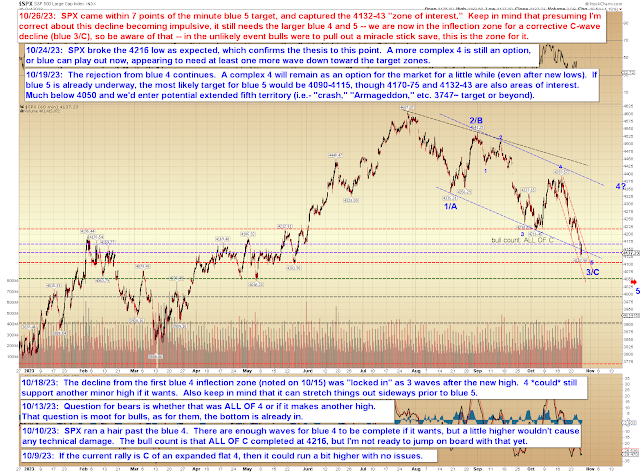

On the NYA chart, I mentioned the option of "just a LITTLE lower," and this is because nailing down the exact end of fifth waves isn't always as simple as "well, it captured the target, we can all go home." So, there's an in-between option that isn't as dramatic as the fifth wave extension, but that still delays bulls from any warm and fuzzies yet. The chart below discusses one such potential:

COMPQ hasn't quite invalidated the diagonal from a technical standpoint, but I ultimately continue to favor the bears, as I have for the past few months.

[Note: Typo. "~13520" should instead read "~12520."]

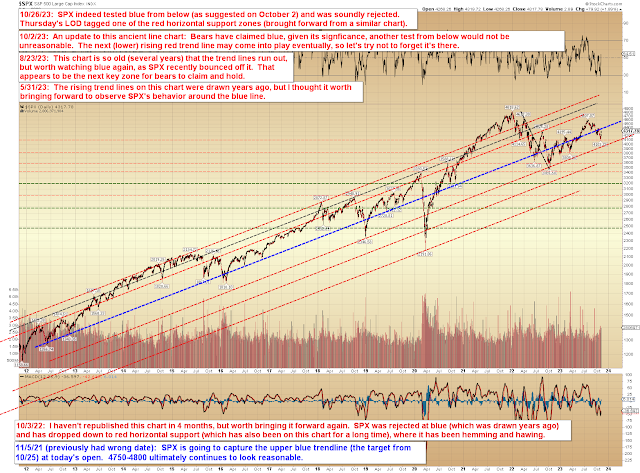

Finally, the SPX "roadmap" chart continues to track well, and time and price have again collided to keep SPX riding right along the blue line:

On the chart above, it's worth a brief mention that SPX has not quite overlapped the a/1 high, which sits at 4101. Overlap there is going to take some of the wind out of bulls' sails, and I would expect once it happens, the previously bullish Elliotticians will get on the bear bus (unless they're hopeless permabulls) -- if they haven't already done so with the overlap at blue b (which is where most of them probably think the wave 1 peak is). This will be annoying, because I hate when everyone agrees with me, especially when it comes to trading. But it's a necessary evil, I suppose, though it may lead to the market throwing some kind of curveball to try to shake everyone again.

I mention this because it's one of the reasons I've been considering the possibility of an extended fifth: An extended fifth wouldn't allow latecomers on board, and it would keep bulls trapped. So those who have only recently woken up to the possibility that the market is in a high-degree third wave won't be able to profit from it. In fact, they will most likely lose money, even with their newfound knowledge, because there's a strange tendency traders have where if they aren't short heading into a steep drop (such as we just had), they will start bottom hunting and buying way too early. Not because they're necessarily bullish, but mainly because they aren't short and they're trying to get in on the action. Or they're trying to recover the losses from their stopped-out longs.

So, if you put it all together, there's some psychological impetus for the market to just keep dropping here. Extended fifths are brutal, some of the worst waves one can encounter because they move very quickly and only come up for air long enough to grab a few stops (on the shorts) and sucker a few bulls -- then they resume their relentless waterfall. They don't bounce hard until they're entirely done (then they bounce fast and brutal, your textbook V-bottom massive "short covering rally" -- which then, after it has stopped all the shorts and lost money for everyone who shorted the hole, retraces and becomes more of a W-bottom to shake the late buyers before bouncing even harder).

Anyway, we'll see how it plays here. The short version is this:

- SPX has captured its Wave 5 target and does not need to go any lower. It could form a decent bounce from here (plus or minus a little). If one has been following these updates, then one already has hundreds of points of profit and may not feel the need to get overly greedy (not trading advice). Maybe it's that simple.

- Wave 5 still has the option to extend/waterfall if it wants.

- There's an in-between option that keeps everyone guessing for a while and which could also satisfy the "burn the former bulls who are now buying too early" scenario discussed at length above.

- In options 2 and 3, there could be a short-lived bounce toward one of the noted resistance/inflection zones before the downtrend resumes.

That's about all I've got for today. Trade safe.