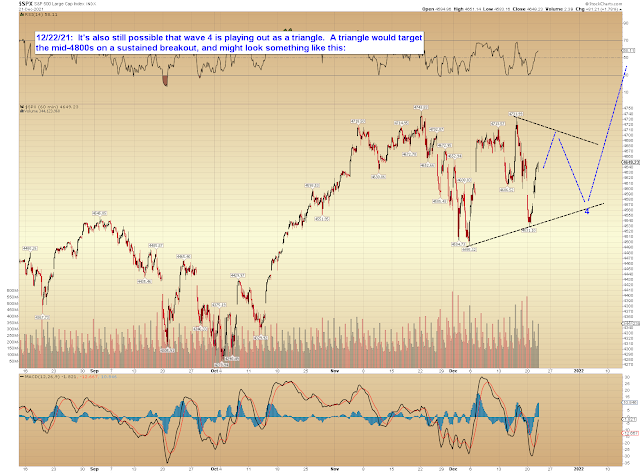

- Wave C played out as a running flat in SPX, instead of the more common expanded flat.

- The low is a micro b-wave, which could run toward SPX 4742-60 in a micro c-wave, before reversing back to break Monday's low.

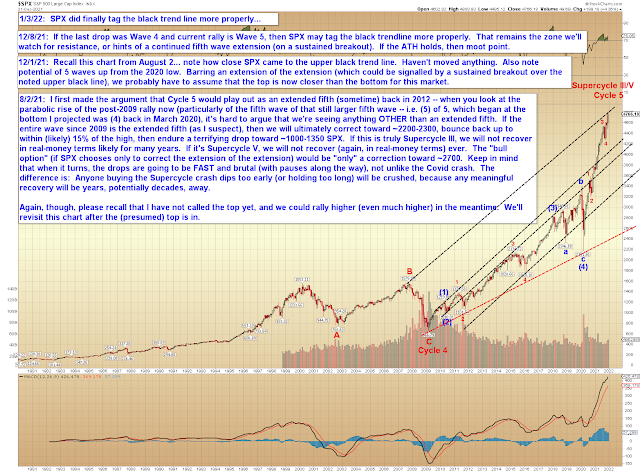

- The entire larger structure is playing out as an ending diagonal (I mentioned this briefly last year), with the ATH being wave i (or possibly even wave iii) of said diagonal, and the recent drop being wave ii/iv.

- SPX is forming a crazy bull nest to launch wave 5 into a large extension.

Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Wednesday, January 12, 2022

SPX and COMPQ: The Good, the Bad, the Ugly

Monday, January 10, 2022

SPX and COMPQ: Still on Target So Far

Friday, January 7, 2022

SPX Update: So Far, So Good

Wednesday, January 5, 2022

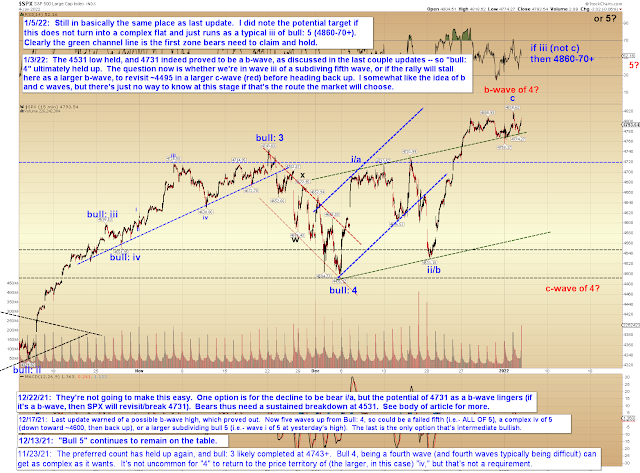

SPX Update: QE is Fun... for a Season

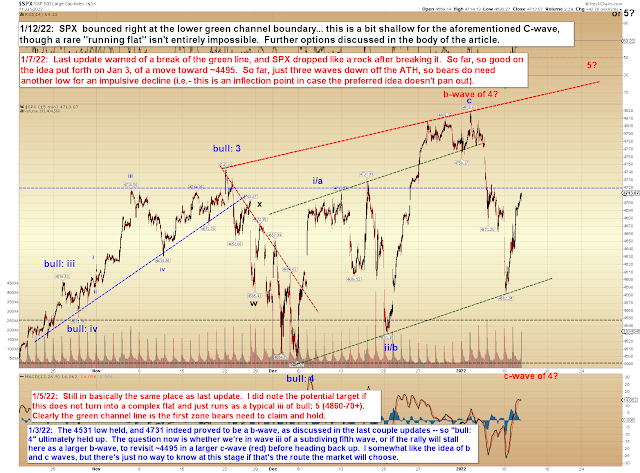

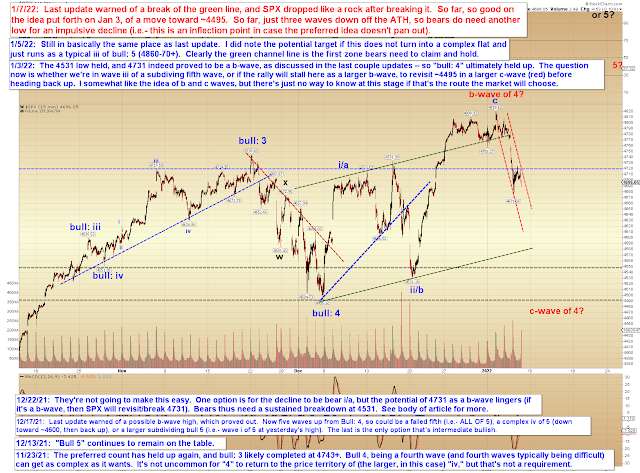

As I noted on the chart, I somewhat like the idea of a complex flat (red b/c), but there's just no way to "predict" that at this stage. If the market instead wants to keep running higher in wave iii of blue bull 5, it certainly can do that.

So no real change there, but I have added a bit to the chart:

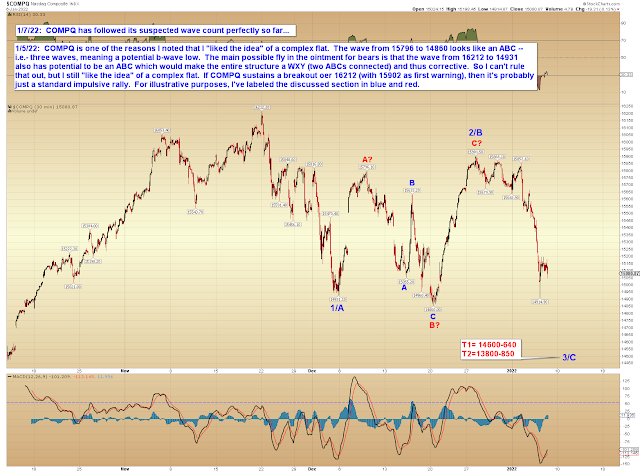

I also thought there might be value in sharing the chart that caught my eye prior to last update -- the chart that led me to "like the idea" of a complex b-wave/c-wave (below):

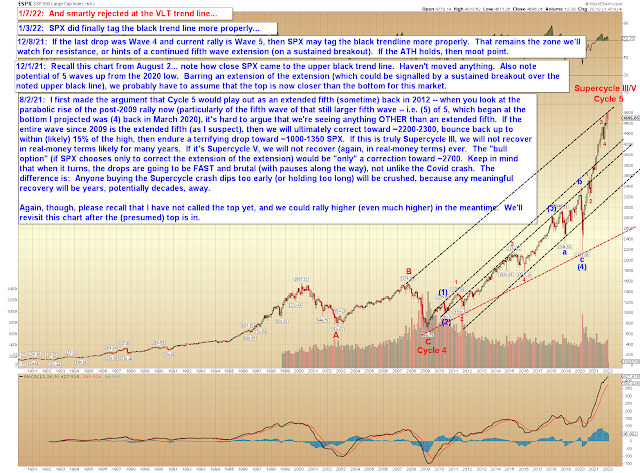

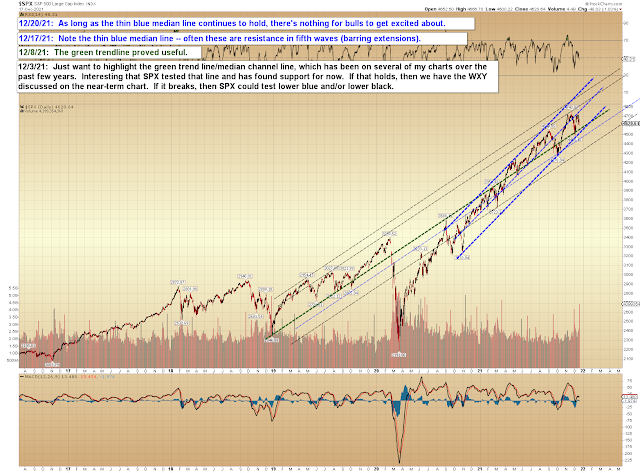

Big picture, SPX is still right up against the upper boundary of the very long-term trend channel:

On another note, it's crazy to consider that SPX is now up seven-fold from the 2009 lows, and triple what it was at the 2007 high. Is the economy three times as strong as it was in 2007? Of course it isn't. But $7 trillion in QE buys a lot of feel-good, I suppose. At least for a while. Kinda reminds me of something my father liked to quote:

"Sin is fun for a season."

In other words: Short-term fun, long-term mess. The problems always come later, when we have to stare down the consequences.

Beyond that, no material change since last update. Trade safe.

Monday, January 3, 2022

SPX Update: 2022

- A complex b-wave high (slight new high, then back below the blue "bull: 4" label, then back above the ATH).

- A subdividing fifth wave (leading to a solid rally)

- An ending diagonal (with the current rally being iii of said diagonal)

Wednesday, December 22, 2021

SPX Update

- A complex b-wave high (slight new high, then back below the blue "bull: 4" label, then back above the ATH).

- A subdividing fifth wave (leading to a solid rally)

- An ending diagonal (with the current rally being iii of said diagonal)

Monday, December 20, 2021

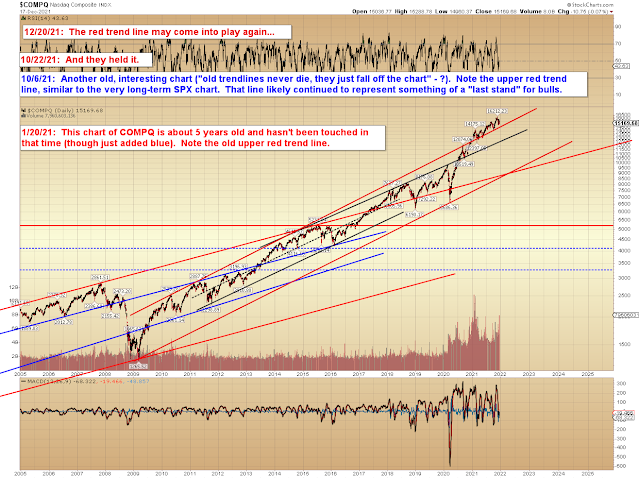

SPX and COMPQ Updates

[W]hile I've been leaning toward a fifth of bull: 5, we now have enough structure in place that we have to more seriously consider the possibility that it completed as a failed fifth. We'll see how the market reacts to the zone near and/or a bit south of 4600 (assuming we get there), and if it can't find support, then we'll take it from there.