Commentary and chart analysis featuring Elliott Wave Theory, classic TA, and frequent doses of sarcasm.

Work published on Yahoo Finance, Nasdaq.com, Investing.com, RealClearMarkets, Minyanville, et al

Join the ongoing discussion with our friendly, knowledgeable, and collegial forum community here!

Amazon

Friday, June 9, 2023

SPX Update

Wednesday, June 7, 2023

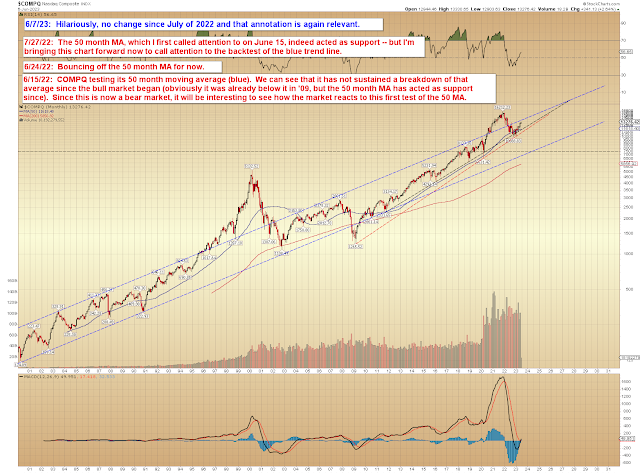

SPX and COMPQ: What's Old is New Again

You know you're dealing with an exciting market when the most recent annotation you wrote on a specific chart was 11 months ago -- but that annotation remains relevant almost a year later.

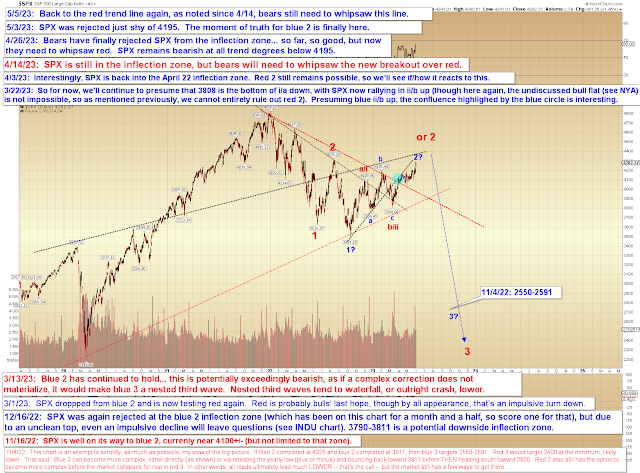

No real change since Monday's update. A reminder that Blue 2 would be off the table north of 4326 -- and that the horizontal zone around 4326 is potential resistance.

In conclusion, this market is rather unique, at least to most people who are trading today. We certainly haven't seen anything like this in decades. I started trading in the 1990s, and I've seen bull moves, bear moves, and sideways grinds -- but during that time, I can't recall a market that spent a full year going nowhere, as this one has. Hopefully, it will also be the last market we see like this for the next 25-30 years. Trade safe.

Monday, June 5, 2023

SPX and NYA: Finally, Something to Talk About

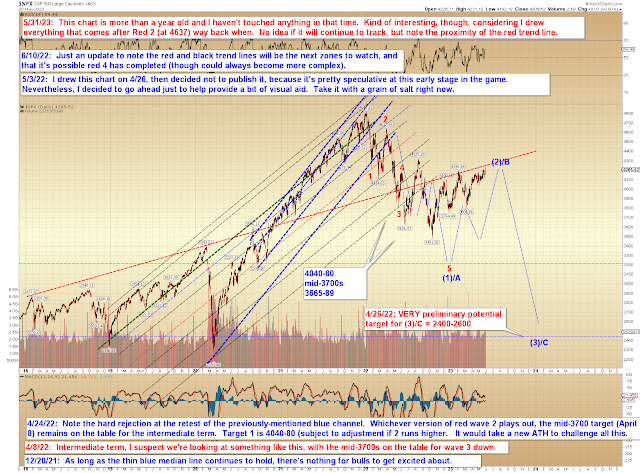

This lag suggests two diametrically opposed possibilities: Either SPX only has a little more upside, and the rest of the market will drag it back down -- or SPX is headed toward at least Red 2 and that will drag the rest of the market up. NYA may become particularly germane here -- IF it can break above the red c/3 high, as it would then need to go on to form 5 waves from the 15055 low. Right now, because of the divergences across markets, it's a bit early to determine how significant SPX's breakout may or may not be, so how these markets collectively behave during the upcoming sessions will be important toward drawing firmer conclusions one way or the other about the larger time frames.

Friday, June 2, 2023

NYA Update: Jerome Powell EXPLODES in Fiery Blast

Wednesday, May 31, 2023

SPX and NYA: Two Interesting Ancient Charts

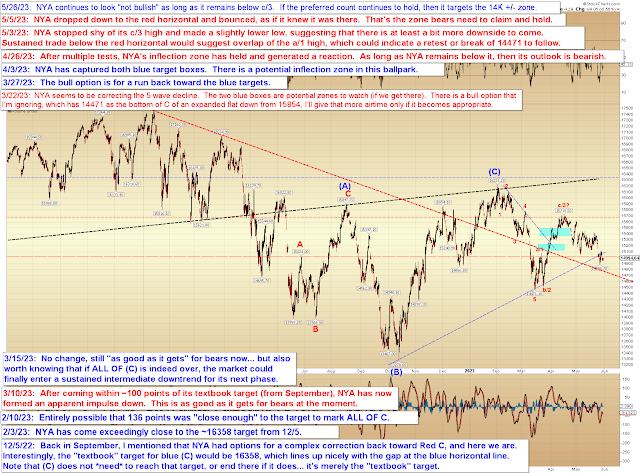

Let's start off with a look at NYA, which continues to lag severely:

Next, a reminder of my current near-term view, which is unchanged since last week:

This lag suggests two diametrically opposed possibilities: Either SPX only has a little more upside, and the rest of the market will drag it back down -- or SPX is headed toward at least Red 2 and that will drag the rest of the market up. NYA may become particularly germane here -- IF it can break above the red c/3 high, as it would then need to go on to form 5 waves from the 15055 low. Right now, because of the divergences across markets, it's a bit early to determine how significant SPX's breakout may or may not be, so how these markets collectively behave during the upcoming sessions will be important toward drawing firmer conclusions one way or the other about the larger time frames.

Friday, May 26, 2023

NYA Update: First target captured, and a look at the most interesting chart

Last update called out SPX 4100-11 as the next zone to watch, and SPX declined to 4103 and found support in that first target zone. As noted last update, if SPX can sustain a breakdown below the first zone, then 4040-51 becomes the next zone to watch.

Since SPX is back into a congestion zone, NYA is far more interesting:

As we can see, NYA has now overlapped the 1/a high, which means that we are likely looking at a 3-wave rally on the heels of the long-presumed impulsive decline (the red 12345 back in March). As long as bears can hold that c/3 high, then things look promising for them.

Other than that, nothing to add to the past couple updates. Trade safe.

Wednesday, May 24, 2023

SPX, INDU, NYA: Revenge of the Lag

This lag suggests two diametrically opposed possibilities: Either SPX only has a little more upside, and the rest of the market will drag it back down -- or SPX is headed toward at least Red 2 and that will drag the rest of the market up. NYA may become particularly germane here -- IF it can break above the red c/3 high, as it would then need to go on to form 5 waves from the 15055 low. Right now, because of the divergences across markets, it's a bit early to determine how significant SPX's breakout may or may not be, so how these markets collectively behave during the upcoming sessions will be important toward drawing firmer conclusions one way or the other about the larger time frames.